Borrow safer

ChainYield

This innovative platform addresses the critical challenges of collateral flexibility, debt management, and prohibitive transaction costs, marking a significant leap forward in making DeFi more accessible and efficient.

ChainYield introduces a revolutionary approach to decentralised finance, facilitating seamless borrowing across different blockchains (Ethereum to Solana). This addresses a fundamental problem in the current DeFi ecosystem - the lack of flexibility and the high costs associated with cross-chain transactions.

- Cross-chain Bridging Users can borrow across different chains seamlessly - from EVM to Solana. ChainYield effectively eliminates the need for asset bridging, which is traditionally associated with high gas fees.

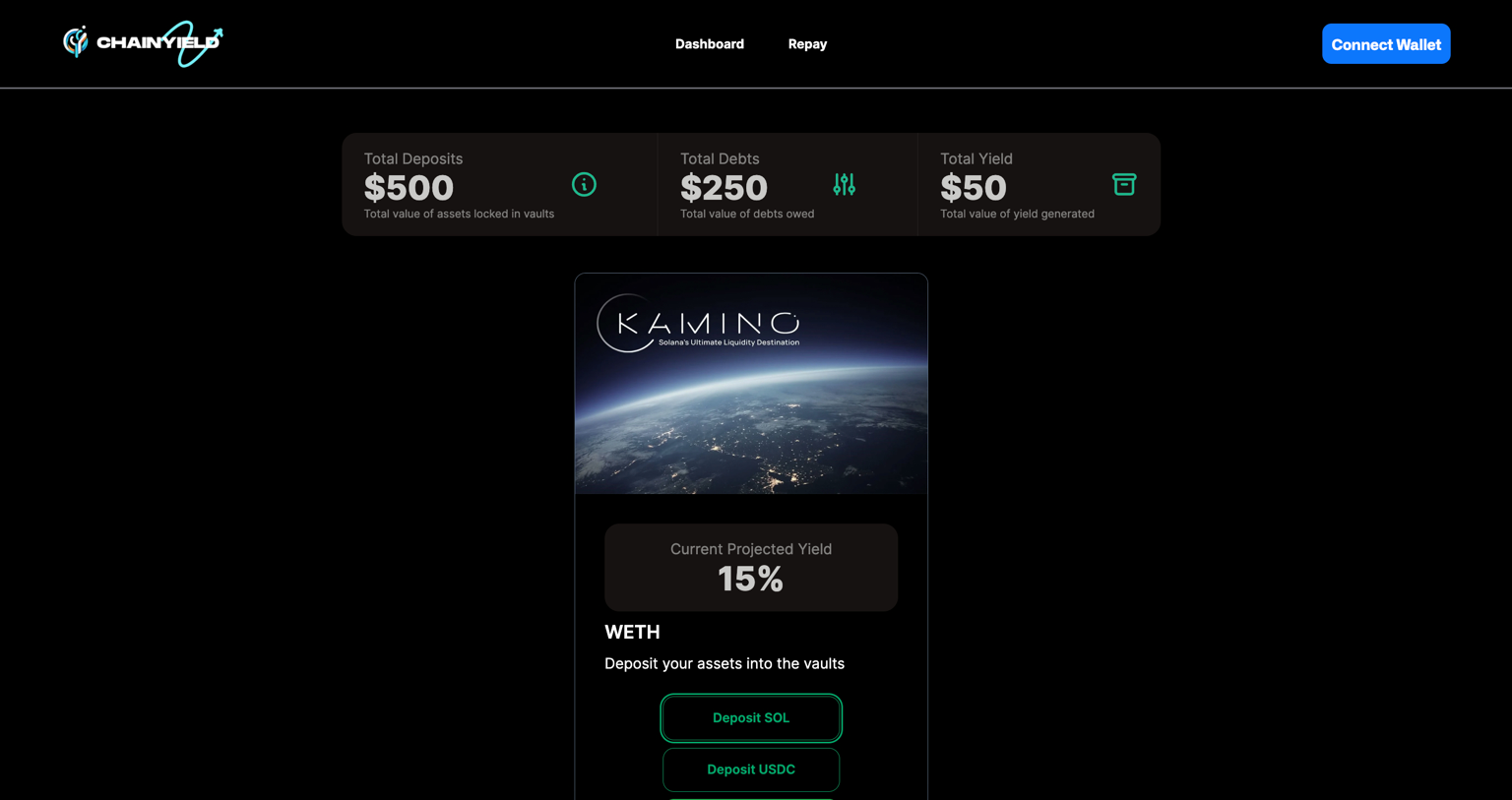

- High-Yield Vault Strategies These vaults maximise yield through various De-Fi strategies and will allow users to take out non-liquidatable self-repaying loans that borrow against future earnings, all without risking your collateral.

- Self-Repaying Loans Loans are automatically repaid without requiring monthly installments or interest. This feature enables users to leverage advances on different yield farming tactics via a synthetic token.

ChainYield stands at the forefront of DeFi innovation, offering a unique and powerful solution to the challenges facing the decentralised finance market today. With its advanced technical features, practical use cases, and strong market adoption strategy, ChainYield is poised to revolutionize the DeFi ecosystem, making it more accessible, efficient, and user-friendly. As we move forward, ChainYield's impact on the market will undoubtedly grow, shaping the future of decentralized finance for the better.

Use Cases & Market Impact

ChainYield is not just a technological innovation; it's a practical solution designed to address real-world challenges in the DeFi market. Here are some key use cases and the impact it aims to have:

Enhanced Accessibility for Borrowers: By simplifying the borrowing process across different chains and reducing transaction costs, ChainYield makes DeFi more accessible to a broader audience. This inclusivity has the potential to drive adoption and foster a more vibrant DeFi ecosystem.

Optimized Investment Strategies: The self-repaying loan model allows users to make the most of their investments. By leveraging the yield from collateral assets for loan repayment, users can more effectively manage their investments and enhance their overall returns.

Market Adoption and Community Engagement: ChainYield's market strategy focuses on leveraging social media, partnerships, and community engagement to drive adoption. This approach, combined with the platform's innovative features, positions ChainYield to significantly impact the DeFi market.